A historic strike by the UAW against Detroit’s Big Three as the Biden administration focuses on the automotive industry

xxuTue, 09/26/2023 - 15:15The International Union of United Automobile, Aerospace and Agricultural Implement Workers of America (UAW) is concurrently striking against Detroit’s Big Three (Ford, General Motors and Stellantis) for the first time in history after the union and automakers failed to reach an agreement before the existing labor contract’s expiration on September 14. The Biden Administration announces significant new investment in the automotive industry as labor negotiations cast a spotlight on the transition to electric vehicles (EV). Inventory lags consensus estimates, a troubling signal for the automotive industry with the initiation of the UAW strike.

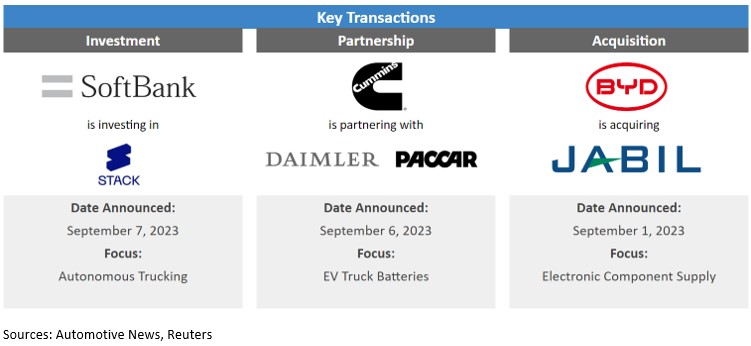

In transaction news, Softbank will invest in autonomous trucking startup Stack AV, led by former Ford and Volkswagen executives. Cummins will partner with Daimler and Paccar on a new battery plant that will support electric trucks. Chinese EV manufacturer BYD will acquire Jabril to grow its mobile component business.

In regulatory news, the National Highway Traffic Safety Administration (NHTSA) announced a hearing date for a potential recall on ARC Automotive’s airbag inflators. Ford announced another significant recall on an additional 169,000 vehicles related to its 360-degree camera system. Hyundai and Kia’s plans for a class action settlement are blocked by a judge in its case related to car theft security measures.

Additional September insights are included below.

Financial Performance

The global semiconductor shortage topped 2.1 million vehicles cut from automakers’ production plans for this year, according to AutoForecast Solutions (AFS). AFS continues to expect 2.4 million vehicles will be cut from production plans for lack of chips in 2023. The shortage contributed to production cuts of 4.38 million vehicles and 10.56 million vehicles in 2022 and 2021, respectively.

Industry Update

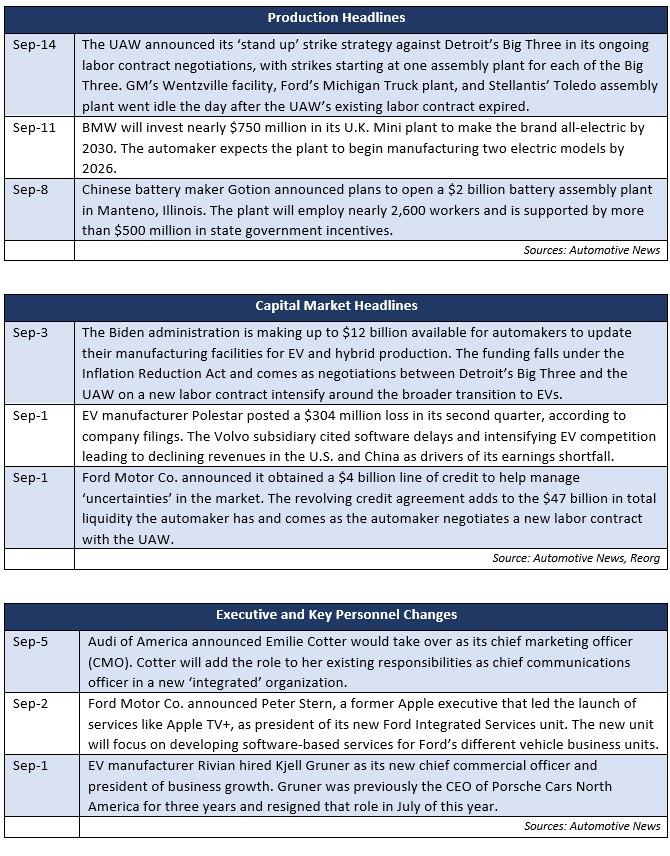

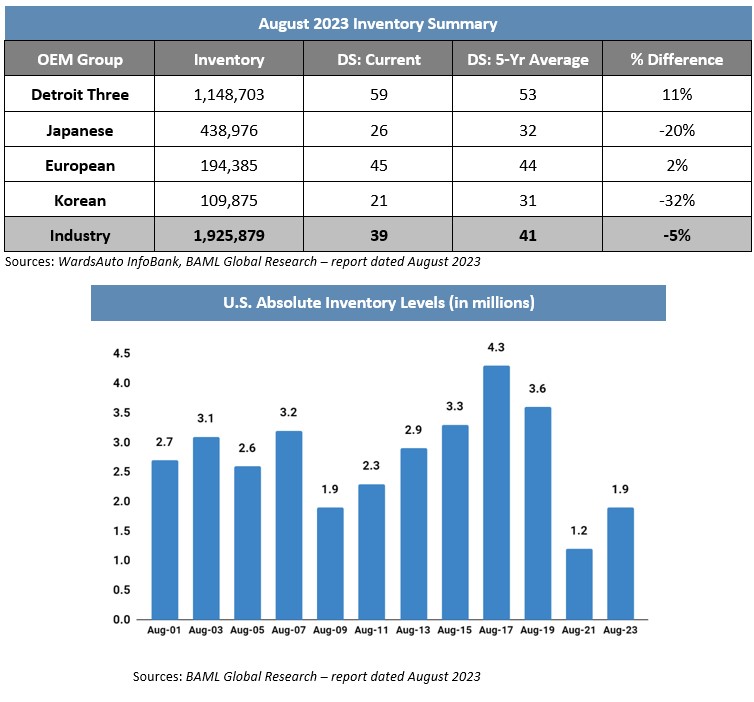

August inventory levels ended at 1.93 million units, a 140,000 unit decrease from last month. Days’ supply (DS) closed at 39, approximately 5 percent below the five-year average and a slight improvement over the last several months. Inventory at Detroit’s Big Three increased month over month, driven by heightened concerns of a strike by the UAW.

August U.S. light vehicle sales increased approximately 14 percent year over year, missing Bloomberg consensus estimates. Vehicle mix continues to remain near record levels, trending toward large vehicles, as average transaction prices remain steady but elevated compared to this time last year. Expectations for full year 2023 remain moderate based on continuously growing production cuts and an increasingly unstable near-term macroeconomic environment, but signs continue to point toward a steeper recovery in 2024.

Industry Focus — An Update on UAW Negotiations with Detroit’s Big Three

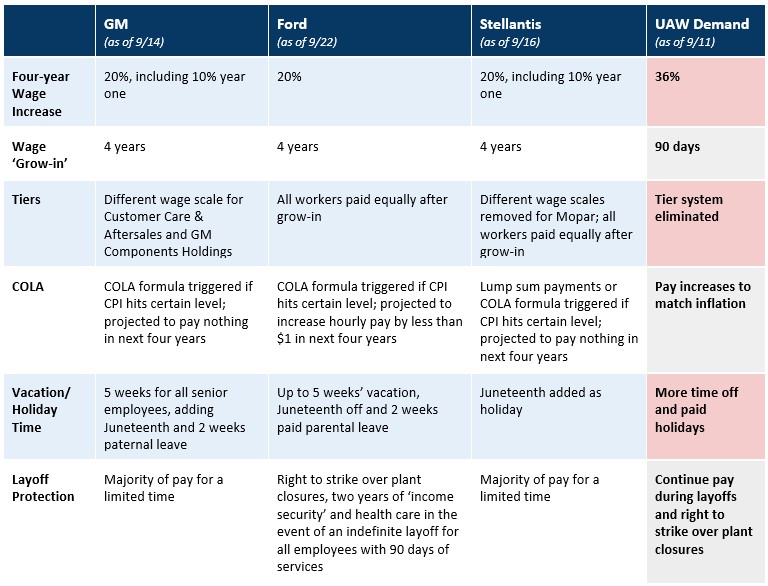

After failing to reach an agreement for a new labor contract with Detroit’s Big Three automakers, the UAW has enacted a concurrent ‘stand up’ strike strategy for its members across each of Detroit’s Big Three. UAW president Shawn Fain announced in a Facebook Live broadcast on September 14th the union would be calling on specific facilities to strike as part of a ‘new approach’ to negotiations, and the union would not back down from its bargaining demands.

‘Keep them guessing’

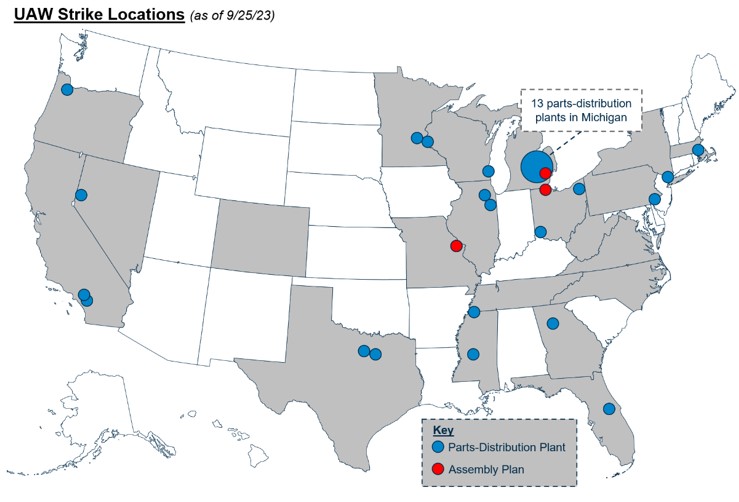

Nearly 19,000 of the UAW’s approximately 147,000 member employees are now on strike across Stellantis’ Toledo assembly plant, Ford’s Michigan Truck plant in Wayne, GM’s Wentzville assembly plant and 38 parts distribution centers operated by GM and Stellantis. While the specific operational impact of the strike remains unknown, the UAW has indicated its strategic intent to disrupt the industry through the entire supply chain. Fain has repeatedly indicated the UAW will likely call on more local membership groups and facilities to go on strike to maximize the union’s leverage.

‘No genuine counteroffer’

Frustration is the common theme for Detroit’s Big Three at the bargaining table. While several rounds of contracts have been sent to the UAW by each automaker, Ford indicated that as of September 13th it had ‘not received any genuine counteroffer.’ While the UAW has notably made minor concessions from initial stances, the union has suggested the automakers still have a significant hill to climb for an ‘acceptable’ deal, despite GM offering what it called an ‘unprecedented economic package.’

Working under expired contracts

While the UAW provided strike orders for three specific plants, the union also gave directions to its other employees to continue working at their respective facilities — despite the fact they are now operating under expired contracts. While wages and working conditions will continue as status quo, the decision to work under an expired contract leaves employees exposed to potential lockouts by the automakers.

Unifor contract negotiations

Unifor, which represents the Big Three's nearly 20,000 Canadian employees, reached an agreement for a new three-year labor contract with Ford on the evening of September 19 after a 24-hour extension to the bargaining period. The agreement averts a potential strike in Canada against Ford and is a positive sign for the UAW's separate negotiations with Detroit's Big Three. Unifor ratified the deal with Ford with 54 percent member approval. The three-year agreement locks in wage increases of nearly 20 percent over the life of the contract, cost of living adjustments and a reduction in the time required to reach the top pay scale.

A limited number of employees on strike, but a significant impact

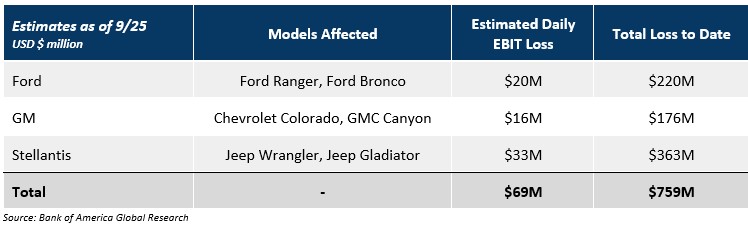

The UAW concentrated its initial strike efforts on three specific assembly plants where the impact on the automakers is financially meaningful. For each of the Big Three, the assembly plant strikes have shut down production for models that are among the most profitable and in-demand vehicles. Bank of America Global Research (BofA Global Research) estimates a total daily impact of almost $70 million across the Big Three:

One week after the start of the initial assembly plant strike, Fain announced incremental strikes at all GM and Stellantis parts distribution plants. Citing ‘significant’ progress at the bargaining table with Ford as a reason the automaker would be spared from further strikes for now, Fain indicated little progress with GM and Stellantis on key issues and reiterated the UAW’s willingness to strike additional facilities.

What happens now?

Fain indicated negotiations were not making sufficient progress with GM and Stellantis, going so far as to say they are no closer to a deal than they were prior to the previous contract’s expiration. While Fain said Ford was making encouraging steps toward what the UAW was seeking, the automaker still had ‘a long way to go.’

The Biden administration has followed progress between the UAW and the automakers closely, with President Biden delivering a statement on September 14 that strongly supported the UAW’s position, echoing their sentiment that ‘record corporate profits should be shared by record contracts for the UAW.’ In the days following the commencement of the strike, Fain stated that the administration is ‘not involved in negotiations,’ and the senior White House adviser Gene Sperling and acting Labor Secretary Julie Su would no longer be coming to Detroit to aid negotiations.

Upstream effects of the strike are already being realized for automakers and their suppliers. By September 18 (just four days of strikes at the three initial assembly plants), GM and Ford had both announced temporary layoffs and plant shutdowns:

- Ford announced 600 employees would be indefinitely laid off from its Michigan Assembly plant. The facility relies on parts that are coated at the paint shop in the plant the UAW targeted in its first wave of strikes.

- GM announced up to 2,000 employees would likely be indefinitely laid off early in the week of September 18 from its Fairfax assembly in Kansas. The assembly plant is dependent on critical stampings from GM’s Wentzville assembly that is part of the UAW’s first wave of strikes.

- Stellantis announced nearly 370 workers in Ohio and Indiana would be temporarily laid off as a result of the Toledo assembly plant being shut down during the UAW strike.

Risk to suppliers is increasing

Perhaps continuing to face the most uncertainty are automotive suppliers that work with Detroit’s Big Three. The ‘stand up’ strike tactics employed by the UAW, designed to confuse the automakers and keep them guessing on what will happen next, will have a potentially devastating effect on the suppliers that are working to anticipate their businesses’ liquidity and operational priorities. Bloomberg estimates that automotive suppliers could stand to lose up to $38 billion if the scope of the strike expands.

While the Biden administration has indicated they are prepared to offer emergency economic aid to suppliers affected by a long-term strike, the ‘stand up’ strike is already having a significant impact. Fallout already reported includes:

- Detroit-based seating supplier LM Manufacturing laid off nearly 650 employees, citing the strike at Ford’s Michigan Assembly plant. LM Manufacturing supplies parts for the Ford Bronco and is a joint venture between Canadian supplier Magna International and LAN Manufacturing.

- CIE Newcor, a component maker for tier 1 suppliers in Michigan, warned it would potentially lay off 293 employees in a temporary closure.

- German-based automotive supplier ZF indicated it has already laid off some workers at several sites but declined to specify which facilities and how many employees. ZF supplies components for vehicles made at all plants affected by the strike and noted an immediate impact on its operations.

- U.S. Steel said it would temporarily idle one of its furnaces at its Granite City steel plant in Illinois as a ‘risk mitigation’ measure and is evaluating how many of its approximately 1,400 employees at the site will be impacted.

A recent report by MICHauto, a Michigan-based advocate group for the automotive industry, claimed a prolonged strike could result in layoffs that could reach the tens of thousands. They estimate that for every direct automaker job, the automotive supply industry employs six to ten people.

Transaction Activity

- (9/7) SoftBank will invest more than $1 billion into Stack AV, a new autonomous trucking startup created by former Ford and Volkswagen self-driving executives. The startup has hired 150 employees and has a test fleet of trucks on the road. It is primarily built from the remnants of Argo AI, a self-driving operation that Ford and Volkswagen invested more than $3.6 billion into before shutting it down in 2022.

- (9/6) Cummins, Daimler and Paccar will partner on a $3 billion battery plant that will support electric trucks. Each firm will own 30 percent of the venture with EVE Energy holding 10 percent as a technology partner. The factory, the location of which is still to be determined, will target starting production by 2027 and focus on lithium-iron-phosphate cells.

- (9/1) Chinese electronics conglomerate and EV manufacturer BYD is buying Jabil Circuit’s mobile parts business in China for $2.2 billion. The acquisition will expand BYD’s customer base, product portfolio and components business.

Regulatory Landscape

ARC Automotive Airbag Recall: The NHTSA set a public hearing date of October 5 for the recall of 52 million airbag inflators manufactured by ARC Automotive. The hearing is the latest effort the regulatory body has made to force a recall of the inflators that are at risk of exploding and sending shrapnel at drivers during a vehicle crash. More than a dozen automakers have the affected inflators installed, including GM, Ford, Toyota and Tesla.

Ford 360 Camera System Recall: Ford announced it would be recalling an additional 169,000 vehicles affected by a software issue with its 360-degree camera system. The company previously recalled 422,000 vehicles in May of this year and indicated in a filing with the U.S. Securities and Exchange Commission (SEC) it would spend nearly $270 million to fix the issue on affected models. Ford has now issued 42 recalls across 4.6 million vehicles this year, the most of any automaker.

Hyundai and Kia Vehicle Theft Settlement: A U.S. federal judge denied Hyundai and Kia’s proposed $200 million class action settlement agreement related to vehicle thefts driven by poor safety systems. The judge ruled the amount would not be sufficient for certain owners and asked the automakers to revise their settlement in the next three weeks.

Stay connected to industry financial indicators and check back in October for the latest Auto Industry Spotlight.

Automotive Industry Spotlight Archive